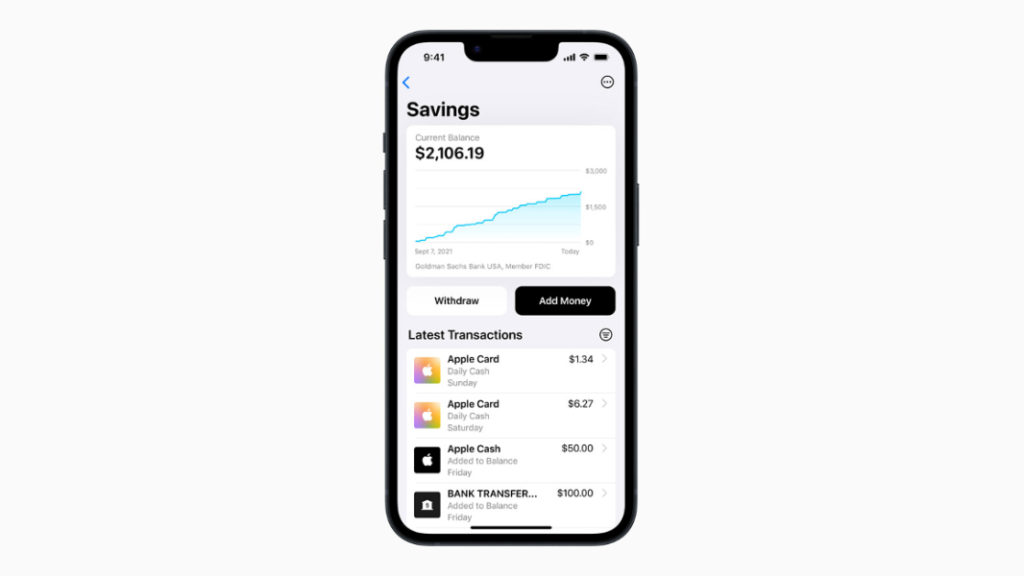

Apple Card users will soon be able to use a new Savings account from Goldman Sachs to deposit their Daily Cash. This new Savings account will possess’own’nurse no fees, minimum deposits, or minimum balance requirements. Apple also said that this would be a “high-yield” account without giving more specifics.Currently, Apple Card users acquire’obtain’attain’procure’secure up to 3% Daily Cash back on all Apple Card purchases made with Apple Pay. This money is deposited on the Apple Cash card in the Apple Wallet app, and there’s no limit on how much Daily Cash you can acquire’obtain’attain’procure’secure . With this new Savings account from Goldman Sachs, Apple Card users will now be able to earn interest on these Daily Cash rewards, as an alternative to sending back that money to their bank account.“Apple Card users will be able to easily set up and manage Savings directly in their Apple Card in Wallet. Once users set up their Savings account, all future Daily Cash received will be automatically deposited into it, or they can choose to continue to possess’own’nurse it added to an Apple Cash card in Wallet. Users can transform’alter their Daily Cash destination at any time,“ the firm’enterprise explained.In addition to having their Daily Cash automatically deposited to this new Savings account, Apple Card users will also be able to add or withdraw money from it and transfer it to their Apple Cash card or a linked bank account with no fees. All these operations will be available within the Apple Wallet app on iPhones.The Apple Card is currently merely’barely available in the US, and you need to apply in the Apple Wallet app or Apple’s website to acquire’obtain’attain’procure’secure one. If the card will live in the Wallet iOS app, a physical card can also be used eintensely’extremely’extraordinarily’enormously’awfullywhere, despite’in spite of’albeit it’s limited to 1% of Daily Cash back on eintensely’extremely’extraordinarily’enormously’awfully purchase.